-

Chandrakant 'CK' Isi

21:15 02nd Jan, 2017

Government-Backed BHIM Payment App Takes On PayTM | TechTree.com

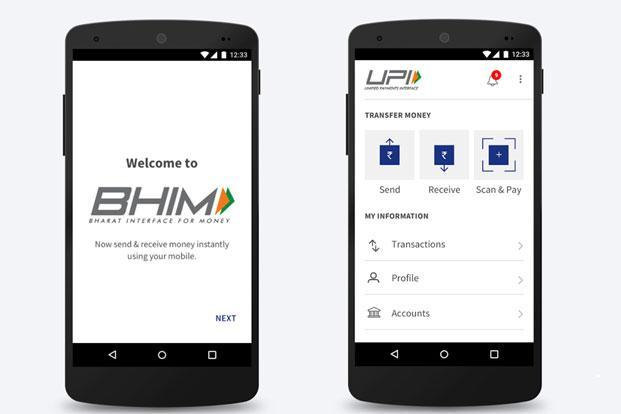

Government-Backed BHIM Payment App Takes On PayTM

Using UPI, it connects directly to your bank accounts.

To get rid of the black money, Prime Minister Modi demonetised the Rs 500 and Rs 1000 currency notes. The move has caused a shortage of currency bills. To normalise the situation, the government has been asking the people to use the cashless payment modes. In order to boost the adoption rate, National Payments Corporation of India (NPCI) has launched the BHIM (Bharat Interface for Money) app for Android smartphones.

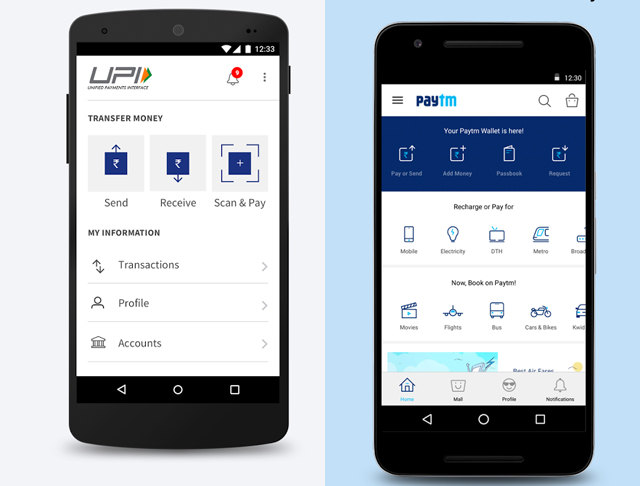

It enables secure and reliable cashless payments through your mobile phone. Unlike PayTM and Freecharge, BHIM is connected directly to your bank accounts. The app connects your bank account with UPI (Unified Payment Interface). Once you are through the setup, you can send and receive money directly from mobile. Custom Payment Address: You can create a custom payment address in addition to your phone number. The app interface is quite similar to that of PayTM. Money can be sent to non UPI supported banks using IFSC and MMID. Through the app, you can transfer maximum of Rs 10,000 per transaction and Rs 20,000 within 24 hours.

It is supported by popular banks such as Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of Maharashtra, Canara Bank, Catholic Syrian Bank, Central Bank of India, DCB Bank, Dena Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, RBL Bank, South Indian Bank, Standard Chartered Bank, State Bank of India, Syndicate Bank, Union Bank of India, United Bank of India, and Vijaya Bank.

Download link: Click here.

TAGS: Android Apps

- DRIFE Begins Operations in Namma Bengaluru

- Sevenaire launches ‘NEPTUNE’ – 24W Portable Speaker with RGB LED Lights

- Inbase launches ‘Urban Q1 Pro’ TWS Earbuds with Smart Touch control in India

- Airtel announces Rs 6000 cashback on purchase of smartphones from leading brands

- 78% of Indians are saving to spend during the festive season and 72% will splurge on gadgets & electronics

- 5 Tips For Buying A TV This Festive Season

- Facebook launches its largest creator education program in India

- 5 educational tech toys for young and aspiring engineers

- Mid-range smartphones emerge as customer favourites this festive season, reveals Amazon survey

- COLORFUL Launches Onebot M24A1 AIO PC for Professionals

TECHTREE