-

Team TechTree

11:58 14th Jul, 2016

Out Of Cash? Try Earlysalary.com app | TechTree.com

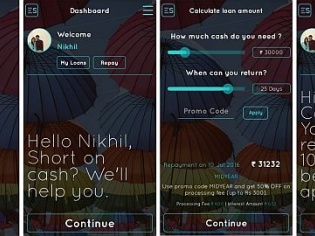

Out Of Cash? Try Earlysalary.com app

The app works on a social algorithm that allows to get loans within 10 minutes of applying at feasible interest rates.

With the cost of living in most of the nation's metropolis being on the higher side, it’s not uncommon to have people run out of cash, especially during the latter half of the month. Earlysalary app comes as a major boon in that regard with their new social algorithm based app, which will grant people instant cash loans, at feasible rates, within as little as 10 minutes! The Machine Learned Algorithm called Social Worth is already in operation, helping Earlysalary.com expand operations to 4 cities in India (Mumbai, Chennai, Pune, Bengaluru), dishing out loans to young professionals, who have already downloaded the 130,000 times+ already.

The application currently is running for both Android and iOS operating systems, and makes it rather easy to get instant cash during money crunching times. The amount could be anything between INR 10,000 to INR 1 lakh, for a tenure that could range between 7 days to 30 days. operates similar to cash advance or cash withdraw from a credit card or salary advances. Mumbai was selected basis an internal social media city score analysis developed by EarlySalary.com. The company operates on the basis of a user’s Social Worth Score to approve and process loans. Social Worth Score combines credit bureau reports & social media details of the user and helps the company in decision-making. User can get instant fund transfer to his bank account and can use it as per their requirement.

“Machine Decisioning hold the turning point for disruption in the Financial and Banking Space. Over the past few months, we have worked towards building our Machine Decisioning System, which is now in production environment and allows us to start scaling operations. We hope to do inorganic growth and double our loan volume every month for next quarter by implementing our Social Score Card. EarlySalary.com’s technology disruption in lending business will hopefully pave way to offer Credit Solution to young working Indians,” said Akshay Mehrotra, Co-founder and CEO of Earlysalary.com, while elaborating about the designing of the app.

To sum it up, the earlysalary.com highlights would include getting a loan of INR 10,000 to INR 1,00,000 with:

1. Machine Decisioning System Powered by Social Underwriting System and Score Card

2. Instant approved Credit Limit

3. Same day cash transfer

4. Interest rates average at INR 7 per day per INR 10,000

5. Decisioning in few minutes

In order to apply for a cash loan, one needs 3 documents:

a. Facebook ID

b. PAN number

c. Bank Log-in verification or Statements

TAGS: Earlysalary, credit, loans

- DRIFE Begins Operations in Namma Bengaluru

- Sevenaire launches ‘NEPTUNE’ – 24W Portable Speaker with RGB LED Lights

- Inbase launches ‘Urban Q1 Pro’ TWS Earbuds with Smart Touch control in India

- Airtel announces Rs 6000 cashback on purchase of smartphones from leading brands

- 78% of Indians are saving to spend during the festive season and 72% will splurge on gadgets & electronics

- 5 Tips For Buying A TV This Festive Season

- Facebook launches its largest creator education program in India

- 5 educational tech toys for young and aspiring engineers

- Mid-range smartphones emerge as customer favourites this festive season, reveals Amazon survey

- COLORFUL Launches Onebot M24A1 AIO PC for Professionals

TECHTREE